How to set up Custom Properties

Learn about Custom Properties for Meeting Services

This article includes:

What are Custom Properties

The types of Custom Properties

Use of Custom Properties

Create and set up Custom Properties

What are Custom Properties

Custom Properties are information fields for tax laws and policies that your organization might have, that the users fill out when a catering request is created in either the Services Add-in or the Services Management Portal. The Custom Properties are completely customizable and can be created for both users of the Add-in and the users of the Services Management Portal (canteen or kitchen personal).

The types of Custom Properties

The Checkbox

This kind of Custom Property is a single checkbox. It is mostly used for yes/no questions or rules.

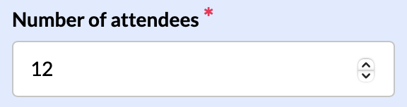

The number field

This kind of Custom Property is a single-line input field that only accepts numbers. This is mostly for information like the number of internal/external attendees, an order number, etc.

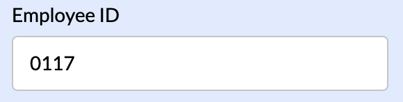

The text field

This kind of Custom Property is a single-line input field that accepts all characters. This Custom Property can be set up to provide any kind of short tax information.

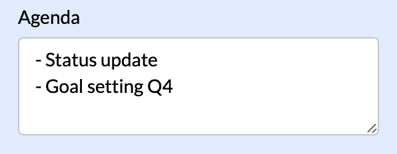

The Multi-line text

This kind of Custom Property is a multi-line input field that accepts all characters. This Custom Property is mostly used to provide larger amounts of tax information. This could be the agenda for the meeting or the subject.

The drop-down field

This kind of Custom Property is a drop-down list of options that can be defined with a display name shown in the add-in and an underlying value used for reports. This is similar to how cost centers are handled with a display name and a value. This provides a flexible solution that is easy to configure from the Admin Center.

Use of Custom Properties

The Custom Property can be created for either the Services Add-in users or for the Services Management Portal users (Canteen or Kitchen personal).

Mostly the Custom Properties created are for the Add-in users to add information about the meeting, but in some cases, it can be necessary to create a Custom Property specific for the users of the Services Management Portal.

Example: The kitchen can create Ad-hoc requests directly in the Services Management Portal, and because they don't create the request through Outlook, they don't get the information about the meeting room or the host automatically. It is then sometimes needed to create a Custom Property only available for the kitchen when they create Ad-hoc requests. The Custom Properties are only for the kitchen will not be visible in the Add-in.

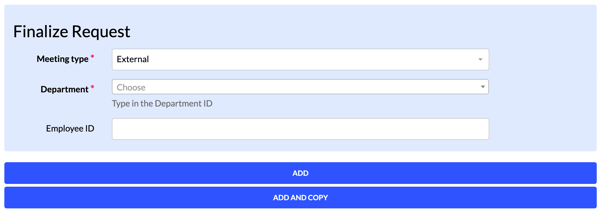

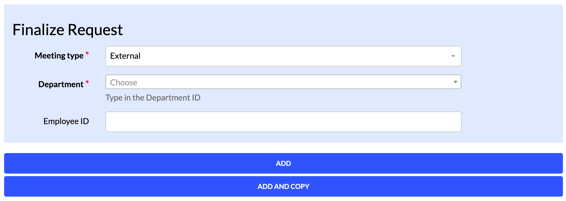

See the picture below for a visual example.

Custom Properties created can visually be represented in the Services Management Portal for the Canteen and Kitchen personal to see, in emails sent from the Services Management Portal, on print-outs, and on Reports on CSV and API, if the configuration is set. See how to set it up in the next section.

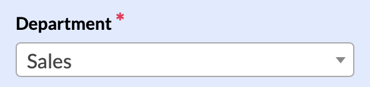

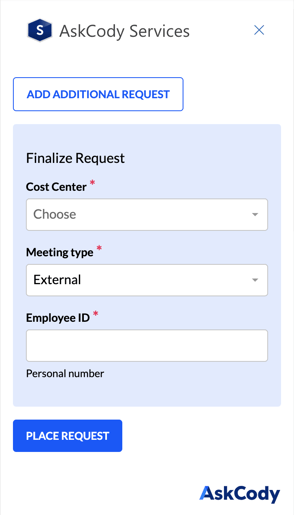

Example of what Custom Properties could look like in the Services Add-in:

Example of what Custom Properties could look like in the Services Management Portal:

Create and set up Custom Properties

The role required for setting up Custom Properties: Owner or Services Administrator

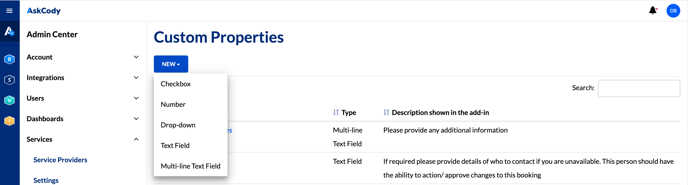

Step 1: Create your Custom Properties

Go to Admin Center → Click Services and select Custom Properties → Click New and select the kind of Custom Properties you want to create → Fill in the information according to the instructions and click Add.

*Click the "Ad-hoc only" check-box to only make it available in the Services Management Portal for the Kitchen and Canteen personal.

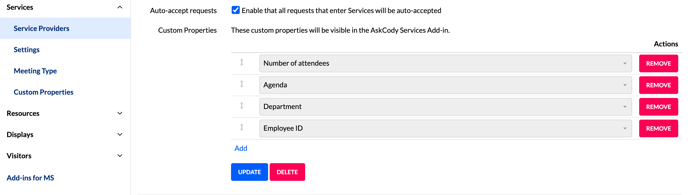

Step 2: Attach the Custom Properties to a provider

Go to Admin Center → Click Services and select Service Providers → Select a provider → Add the Custom Properties at the bottom of the page and click Add

![Logo - Secondary White-1.png]](https://help.askcody.com/hs-fs/hubfs/Logo%20-%20Secondary%20White-1.png?height=50&name=Logo%20-%20Secondary%20White-1.png)